Why Mutual Funds May Be Hazardous to Your Financial Health

Mutual funds are often touted as the most effective and convenient tools for individual investors and managers to build diversified portfolios.

However, investor experience is often subject to the whim of the mutual fund manager when it comes to the size and timing of dividends, and, especially, capital gains distributions. If they occur within a taxable account, unpredictable distributions can leave an investor flat-footed when it comes to tax management and overall financial planning.

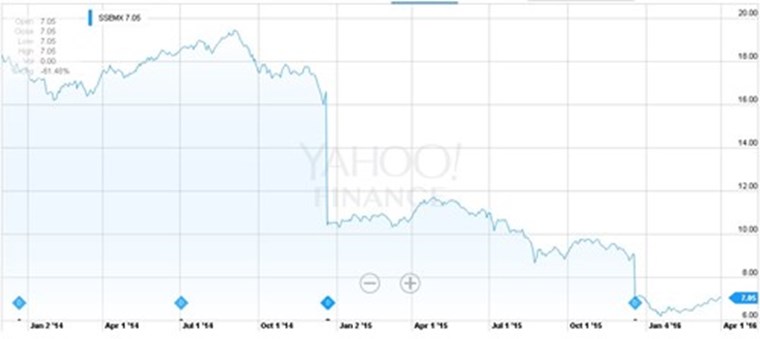

For example, let’s look at State Street’s Emerging Markets fund (ticker SSEMX; full name has changed over time).

On December 20, 2013, SSEMX paid out $0.224 per share, or 1.28% of the share’s price, to investors. It broke down as a $0.1275 dividend and a $0.0956 cap gain distribution. This looked like entirely reasonable year-end payout, and followed a history of similarly small distributions.

On July 2, 2014, SSEMX paid a dividend of $0.047 per share or about 0.25% of its price – fairly par for the course as a mid-year distribution, an investor might think.

On December 19, 2014 though, the fund issued a payout of $6.232 per share, broken down as a $0.3942 dividend and a $5.8376 cap gain distribution. Along with a slight market movement, these actions sent the price of one share down from $16.60 to $10.42.

That’s a distribution amounting to a whopping 38% of the starting price or 60% of the ending price, the effect of which is clearly visible in the chart above as a large, sudden, nearly vertical drop in the SSEMX’s price. The main consequence for an investor would be a huge, unexpected tax bill for the payout, as well as a need to worry about re-investing the proceeds in order to maintain the investor’s desired asset allocation.

The fund has issued no further dividends to date. Its next cap gains distribution didn’t come until December 18, 2015, and was $1.989 per share – again unusually large at about 22% of the starting price or 28% of the ending price.

In total, these distributions far exceeded the normal range of dividend yields for equity, fixed-income, or alternative investments in recent memory. SSEMX has an expense ratio of 1.25%. Its 3-year total before-tax return as of 4/5/16, assuming re-investment of all distributions, was -7.17%.

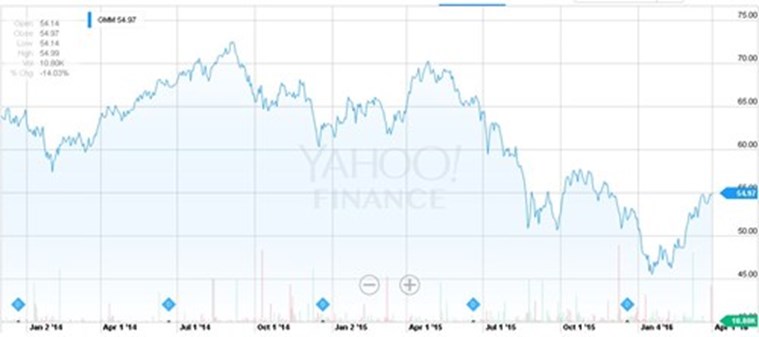

By way of contrast, we may look at the Emerging Markets ETF issued by the same investment firm (State Street), GMM:

Note the predicable, bi-annual schedule of the dividend payouts here – all in the range from $0.46 to $0.86 per share, during a period when the ETF cost between $45.57 and $72.55 per share. There are no abrupt jumps in the share price here of the sort that were strikingly visible in the previous chart for the corresponding mutual fund. And the great majority of a long-term investor’s money would have remained in the fund without being subject to taxes.

GMM has an expense ratio of 0.59% (less than half that of the corresponding mutual fund, SSEMX). Its 3-year total before-tax return as of 4/5/16 (assuming re-investment of dividends) was -4.11% — over 3% higher than that of SSEMX. A taxable investor would have experienced an even greater advantage from investing in GMM, as SSEMX would have returned over half of the investor’s money over this period in distributions — payouts for which the investor would be forced to pay taxes – while the tax bill for GMM’s dividends would have been tiny by comparison.

Mutual fund managers disburse capital gains and dividends to investors either opportunistically to benefit their own after-tax bottom lines, or when forced to by the actions of investors in their funds. Thus mutual funds, in general, issue distributions with no consistency or predictability that could allow taxable investors to manage their accounts and portfolios over time in a reasonably planned-out way.

ETFs, on the other hand, are generally run in a rules-based fashion: with no cap gains distributions, regular dividends tied to the yields of the constituent securities, no benefit to be had by the ETF manager for tactically maneuvering distribution policy based on minimizing the manager’s own tax liabilities, and no payouts forced as a result of the actions of investors in the fund.

New Frontier Advisors invests only in seasoned, liquid ETFs with a policy and history of regular, steady dividend payouts reflective of the underlying securities’ yields, low expense ratios, and no unpredictable or outsize distributions that could wreak havoc on a taxable investor’s financial planning and ability to meet his or her financial goals.

Sources: Morningstar Database, Yahoo Finance

Locate Us

New Frontier Advisors

155 Federal Street

Boston, MA 02110

617.482.1433

Contact us to find out how you can invest in New Frontier portfolios.